The memory market has come under a great deal of strain recently. According to a DigiTimes Asia report, SanDisk informed customers that it would raise NAND flash contract prices by an entire 50% for November.

This wasn’t just another routine price adjustment. Market sources told DigiTimes that the announcement caught many suppliers off guard, prompting companies like Transcend and Innodisk to pause shipments and recalculate their quotes. Transcend went as far as suspending quotations and deliveries starting November 7, citing expectations of “continued favorable market conditions”, which is industry code for “prices are headed higher.”

The Numbers Tell a Stark Story

If you’re wondering whether this represents real market tightness or just opportunistic pricing, the financial results from memory module makers may offer insights.

Transcend reported Q3 2025 consolidated revenue of NT$4.11 billion (roughly $133 million), up 27% quarter-over-quarter and 63% year-on-year. Their gross margins hit 45%, while net profit soared 334% compared to the same period last year.

Innodisk saw similar growth, with revenue climbing 64% year-over-year to NT$3.8 billion ($123 million) and net profit jumping nearly 250%.

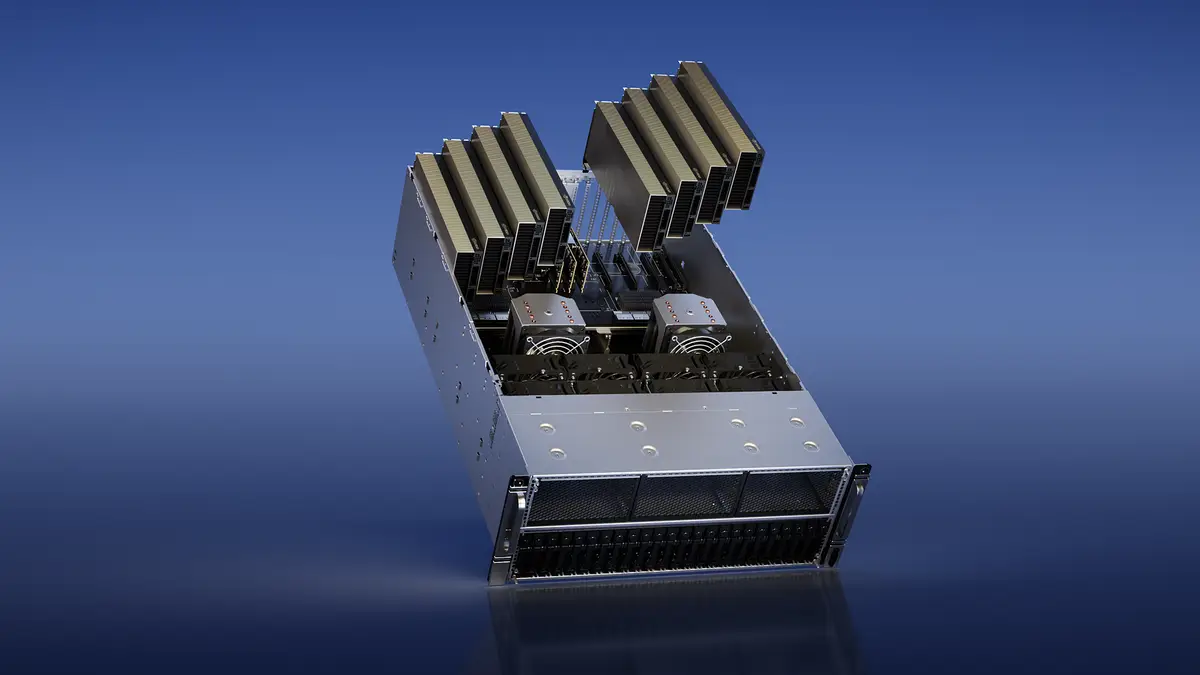

AI’s Voracious Appetite for Memory

The main diver of all this is the explosion of AI infrastructure. Memory manufacturers have redirected their production capacity toward high-bandwidth memory (HBM), DDR5, and other cutting-edge products that command premium prices in AI servers and data centers.

The reallocation creates a squeeze elsewhere. Older DDR4 products—still essential for industrial applications, embedded systems, and legacy computing environments are now in increasingly short supply. When fabs prioritize manufacturing lines for HBM and the latest DDR5 modules, commodity products like consumer SSDs, mainstream DRAM modules, and possibly graphics cards as well get pushed to the back of the queue.

TechInsights projects that HBM demand grew by 150% in 2023, over 200% in 2024, and is expected to expand another 70% in 2025. Since HBM production consumes more than three times the wafer capacity of standard DRAM, this doesn’t leave a lot of room for much else.

Contract Prices Reach Historic Highs

The pressure isn’t limited to NAND flash. DRAM contract prices surged 171.8% year-over-year as of Q3 2025, according to data from CTEE—outpacing even the 88% rise in gold prices over the same period. That makes memory one of the fastest-appreciating commodities in the tech sector right now.

Manufacturers have been absorbing some of these increases and consumers haven’t felt the full impact yet. It could take several months before retail pricing fully reflects the current market dynamics, but the trajectory is clear.

Even companies not directly involved in PC hardware are feeling the pinch. Raspberry Pi raised prices on its Compute Module 4 and 5 in October 2025, with the 4GB versions increasing by $5 and 8GB models rising by $10. CEO

In one of the most dramatic moves (so far), Micron suspended all quotations for its DDR4, DDR5, LPDDR4, and LPDDR5 product lines on September 12, 2025. The company also canceled previously issued contract prices, signaling that it wasn’t interested in discussing long-term agreements for next year. For a supply chain already walking on eggshells, this was a clear message.

The move came as Micron had already notified channel partners about 20% to 30% price increases on DRAM products. In specialized sectors like industrial-grade storage and automotive electronics, some components are seeing hikes as high as 70%.

What Now?

TrendForce forecasts a structural memory price increase through 2026, driven primarily by AI server demand and profit-focused supplier strategies. The firm projects DRAM prices could rise 13-18% quarter-over-quarter in Q4 2025, with NAND flash following a similar trajectory.

Some industry observers believe the shortage could persist far longer. Phison CEO Jiancheng Pan predicted the NAND shortage might last up to a decade if capacity doesn’t expand quickly enough, though that’s one of the more pessimistic outlooks compared to most analysts.

Building new fabrication facilities or converting existing ones requires massive capital investment and takes years to complete. Samsung’s P4L plant is slated for completion in 2025, while SK hynix’s M16 expansion and M15X plant. The latter was originally intended for NAND but repurposed for HBM.

As capital investment is shifting heavily toward DRAM, and HBM in particular, this could create bottlenecks in NAND production. If you’re planning anything from a PC build to a data center expansion, the market conditions suggest acting now rather than waiting for prices to drop. Both DRAM and NAND seems to be facing sustained upward pressure through at least mid-2026.